With the election now behind us and the beginning of the Trump administration coming, economist have begun looking toward what the market will be like in 2025.

At a national Realtor gathering last week, chief NAR economist Lawrence Yun stated that, while the last two years have been tough, the worst may be over. He expects more home sales and lower interest rates. However, the change will be gradual and moderate with rates probably falling by only around half a percent to the low-6s.

With job numbers and stock market gains improving, people are ready to act. He projects the number of existing home sales to rise by 9% and new home sales by 11% and a housing price increase of up to 2%, which is less than the historical yearly average, but not the “bubble bursting” that some have been thinking will happen since at least 2019.

The Fed also made its second rate cut of the year last week and is anticipated to make an additional four cuts in 2025. While mortgage rates aren’t directly tied to the Federal Funds Rate, they are impacted by it.

Policy-wise, if Trump’s “Department of Government Efficiency” can cut government spending even a fraction of what he is call for, that could positively affect the budget deficit and, in turn, the economy. A reduction in housing regulations and energy costs could also positively impact the market.

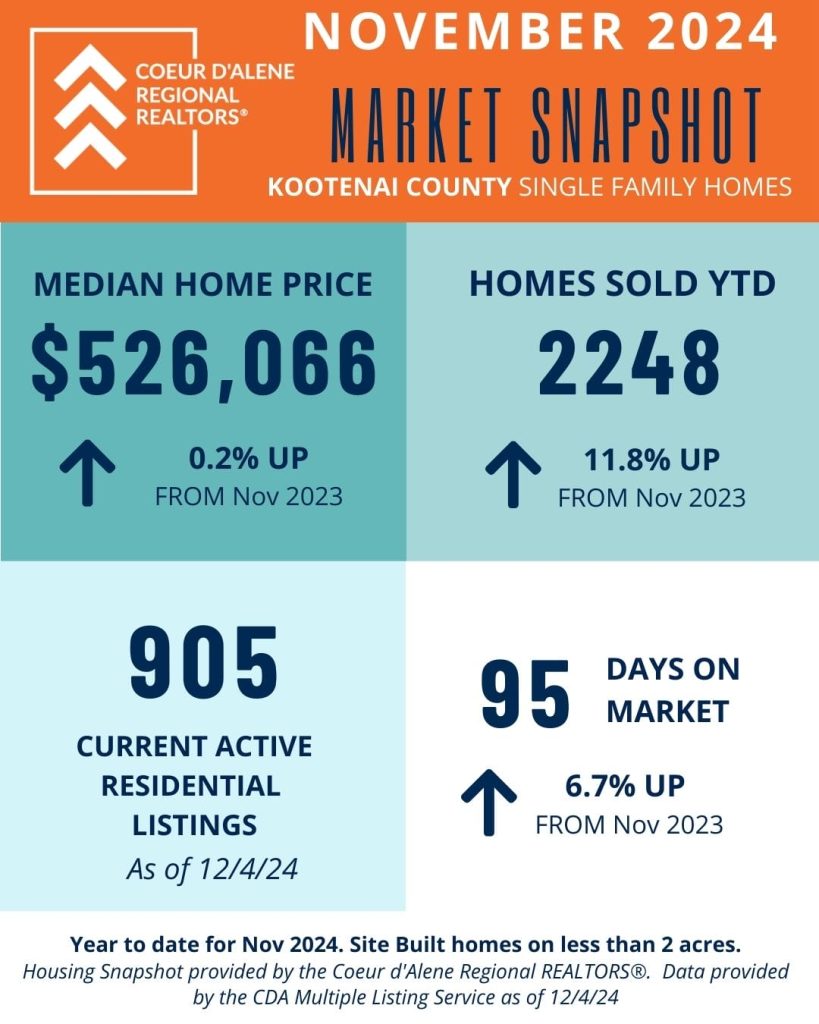

Locally, statistics for November show the median sales price in Kootenai County up 0.2% year over year to $526,066 and units sold increased by 11.8%. Inventory is up 5.8% year over year but down 10.8% from October. There are currently 905 active residential listing and average days on market are 95, up 6.7% from last year.

If you want an estimate of what your home is worth, contact me today.